Since the beginning of November of this year, Russia violating the “Minsk Agreements” has activated combat actions in the East of Ukraine. At the same time, in Syria, apart from the than shock tactical and army aviation it began using the contingent of ground forces of the Armed Forces of the Russian Federation. All this is accompanied with openly hysterical information campaign, in which there are attempts to shift onto Ukraine the responsibility for the violation of the “Minsk Agreements” and to prove the necessity of deepening cooperation between Russia and the West in the fight against international terrorism.

Based on this, V. Putin's regime is trying to talk the US and the EU into lifting of the sanctions against Russia as such that “do not correspond to the present situation”. Addressing this issue is of particular relevance for the Russian leadership because of the critical worsening of the economic situation in the country, creating a real threat of unpredictable developments already in 2016-2017.

Thus, Russia's actual loss of an access to Western credits, investments, markets and modern technologies does not allow to maintain the Russian economy at a more or less stable level, let alone to ensure its development. In particular, lower external demand for Russian companies' production has forced them to reduce their production volumes. As a result — this has led to a drop in their income, which has limited their abilities to buy components, equipment and raw materials, as well as to pay wages to workers. In turn, the above-mentioned processes have caused a chain reaction of a sharp drop in consumer demand already in Russia.

Besides, the economic situation in the Russian Federation is significantly affected by the decline in world prices for energy carriers as Russia's main source of foreign exchange earnings. Since the beginning of this year's autumn, the dynamics of oil prices has resumed the negative trend that has created a critical situation for the Russian oil industry, in terms of its profitability.

In particular, the reason for this was the dumping activities of Saudi Arabia, which began lowering prices for oil exported by it in order to expand its presence in the global energy market. As part of this policy to date, Saudi Arabia has already managed to press Russia on its traditional markets of Central and Eastern Europe (especially Poland and Hungary) and China. In the nearest future we may also expect Iran's large-scale entry into the market (during Putin's recent visit to Iran he failed to agree on this question) which will be a powerful stimulus for further decline in oil prices.

Weakening of Russia's positions at the European gas market continues. Thus, Qatar and Norway are ahead of the Russian Federation in terms of gas supplies, making Moscow continue lowering prices for natural gas for European consumers.

Weakening of Russia's positions at the European gas market continues. Thus, Qatar and Norway are ahead of the Russian Federation in terms of gas supplies, making Moscow continue lowering prices for natural gas for European consumers.

Russia's hopes for possible compensation for Western sanctions at the cost of its partners from the “third world”, primarily China and other BRICS’ members, also failed. Instead of the expected increase in trade with China and Chinese investments into the Russian economy (including design and construction of the luckless Crimean bridge), worsening of China's own economic problems has led to very different results. Since the beginning of 2015, the volume of trade between Russia and China decreased by more than 30 %, and Chinese investments — by about 20 %.

Moscow's plans for reorientation of export flows of Russian gas from Europe to China have not been implemented either. Not a single projects advanced by Russia has actually been started.

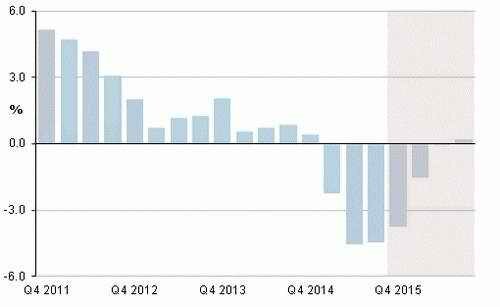

The above-mentioned processes have resulted in the preservation of a stable trend of stagnation of the Russian economy, as evidenced by the drop in GDP, which according to the results of 2015 is expected to reach more than 4 %. At this, the slowdown in falling of the GDP from the forecasted 4.6 % to 4.1 % in October-November this year was caused not by improvement of the economic situation in Russia, but by the increased expenditure on production of ammunition and military equipment as a result of Moscow's interference into the armed conflict in Syria. At the same time, the increased production of weapons (excluding its sales for export) has nothing to do with the work of the real sector of the economy and only requires additional budget expenditures.

Moreover, according to some experts, taking into consideration the decline since the beginning of this year, in automobile building, aviation and high-tech products in Russia from 30 % to 90 %, decline in foreign trade by more than 30 % and in domestic — by about 20 %, and reduction of gas exports by 10 %, in 2015 real shrinkage of Russia's GDP can make 10-15 %. The above-mentioned is knowingly concealed by the Kremlin, including through using “special techniques” for calculation of GDP, which give deliberately inflated results.

At the same time, the Kremlin is trying to convince the public of the possibility of recovery of positive trends in the Russian economy already in 2016. However, the Russian government does not mention any real reasons for these changes, but keeps expressing hopes for lifting of the US and EU's sanctions against Russia and the rise in world oil prices, which are absolutely groundless in the situation of the Kremlin's continued aggressive policy. Taking into consideration the above-mentioned, Western experts predict further catastrophic deterioration of the Russian Federation's economy.

These circumstances lead to complication of problems in Russia's banking-financial sector. The main among them is the increase in the deficit of the state budget due to the decrease in financial income and simultaneous increase in military spending (first of all due to V. Putin's regime's armed aggression against Ukraine and Moscow's military intervention into the conflict in Syria).

Thus, the deficit of the state budget in 2015 is estimated at 3.6 % of the GDP. At this, the Russian Federation's leaderships' attempts to reduce it to 2.8 % of the GDP in 2016 by reducing military spending by 11.6 % (to 1.399 trillion rubles from 1.584 trillion rubles in 2015) have not been implemented. Russia's starting the military operation in Syria made it increase military spending by the same 11 % (175 billion rubles), which necessitated the use of reserve funds and additional savings on other items.

Thus, the deficit of the state budget in 2015 is estimated at 3.6 % of the GDP. At this, the Russian Federation's leaderships' attempts to reduce it to 2.8 % of the GDP in 2016 by reducing military spending by 11.6 % (to 1.399 trillion rubles from 1.584 trillion rubles in 2015) have not been implemented. Russia's starting the military operation in Syria made it increase military spending by the same 11 % (175 billion rubles), which necessitated the use of reserve funds and additional savings on other items.

In particular, to keep the budget deficit at a relatively reasonable 3 % of GDP involves as follows: allocation of 2.1 trillion rubles from the Reserve Fund (75 % of existing reserves with the possibility of further transferring another 500 billion rubles); reducing funding for social budget, including on the development of housing and communal services — by 41.2 %, health care — by 11 % and education — by 8 %; cancellation of compensations for pensions to working pensioners and freezing wages in the public sector; 10 % reduction in funding the federal target program for the development of the Crimea and Sevastopol until 2020.

Despite these measures, the deficit of Russia's state budget in 2016 can rise to 16-17 % of the GDP, which would be the highest figure since the mid-1990s. Thus, according to the Ministry of Finance, budget execution risks in 2016 are more than 1 trillion rubles or 10 % of the revenue part.

Besides, the lack of quick results of the RF Armed Forces' military operation in Syria, makes Moscow attract additional resources to conduct fighting on Syrian territory (including the so-called land-based component), which requires an increase in military spending above the planned limits. We should not exclude the possibility of Russia's getting involved in other armed conflict, which will require greater allocations for military purposes. In particular, there is a possibility of such a conflict in Central Asia, where the activities of Islamic extremists are gaining.

I can't help mentioning the continuing outflow of capital from Russia, which is expected to reach 85 billion US dollars in 2015 and the official Moscow's need to fulfill the state's obligations on debts of Russian companies at around 100 billion US dollars.

According to the Finance Minister A. Siluanov's forecast, considering the circumstances, the complete exhaustion of the Reserve Fund of the country can happen already by the end of 2016 and not in 2017 as previously forecasted in the development of the state budget.

All this also leads to stagnation of Russia's banking system. Since the beginning of 2015, due to a decrease in deposits of individuals and legal entities, falling demand for banking services and loan defaults — the total losses of Russian banks have amounted to about 100 billion rubles. At this, because of the “violation of norms and rules” (and, in fact, bankruptcy), the Central Bank of Russia has taken away the licenses of 70 banks. Problems with capital and liquidity are already experienced by leading banks too, in particular: Uralsib, Russian Standard and Gazpromban, which in some cases are forced to work at a loss. According to the Head of Sberbank of Russia G. Gref, the banking crisis in the country has the largest scale in the last 20 years.

Financial problems of Russian regions keep getting worse. Due to the reduction of subsidies from the federal center, the decline in additional revenue from the enterprises of the local industry and the need to implement social obligations, as of November this year, the total debt of Russian regions reached 2.5 trillion rubles.

A consequence of the crisis processes in the Russian economy and its financial system is sharpening of social problems in Russia.

For example, there is a rapid increase in unemployment, which according to the official data alone has reached more than 6 % of the working population. In fact, this indicator can reach even a greater level, given its hidden forms, including introduction of compulsory leave without pay and shorter working day and week.

For example, there is a rapid increase in unemployment, which according to the official data alone has reached more than 6 % of the working population. In fact, this indicator can reach even a greater level, given its hidden forms, including introduction of compulsory leave without pay and shorter working day and week.

Besides, due to the reduction in wages, pensions and social spending, for the first time since 1999, there has begun real falling of incomes — by 10.1 % with increase in prices by 12 %. The result of this is lower living standards and the increased number of people living below the poverty line. To date, this category includes already 23 million Russian citizens or 14 % of the country's population (in 2014 — 16.1 million people, in 2013 — 15.5 million people).

At the same time, according to the report of the Russian Federal State Statistics Service (Rosstat), inflation in Russia since the beginning of 2015 has reached 12 % (in 2014 inflation since the beginning of the year /for the reporting period/ had made 8.5 %).

At the same time, according to the report of the Russian Federal State Statistics Service (Rosstat), inflation in Russia since the beginning of 2015 has reached 12 % (in 2014 inflation since the beginning of the year /for the reporting period/ had made 8.5 %).

That is, in the period of 2016-2017 the number of the poor in Russia may grow at least 2-2.5 times.

This situation causes the spread of protest moods among the Russian population and strengthening of the citizens' dissatisfaction with V. Putin's policy. Evidence of this was the intensification of protests (including hunger strikes) in different cities of Russia against closures, lower wages and delays in payment. Since 2015, the number of such actions has grown by 45 % as compared with the same period last year.

At the same time, disagreements in the higher echelons of the government of Russia also grow. This, first of all, refers to the increased competition between different business groups close to the leadership of the Russian Federation, for access to government contracts, loans, grants, resources and infrastructure. An example of this are the contradictions between the OAOs Rosneft and Gazprom for the redistribution of government loans and the possibility of preferential use of the Russian gas transit network.

The leadership of the Russian Federation is trying to stabilize the situation in the country by implementing the so-called “anti-crisis plan”, which actually provides for mobilization methods (ways) in economic management. In particular, such methods include: the state's aid only to key sectors of the Russian economy (mainly to the fuel and energy complex, personally controlled by V. Putin and his inner circle); further limiting budget spendings and higher taxes, and other charges of entrepreneurs and population (as a way of solving financial problems of the country at their cost).

They also consider the possibility of applying tougher approaches, including: making exporters sell foreign currency on the domestic market; a ban on the purchase of foreign currency by legal entities without justification for the need of payment transactions; setting fixed prices of food and essential commodities.

At the same time, the critical shortage of funds to replenish the state budget makes Moscow resort to other unpopular measures, which include: issuing money; domestic loans and privatization of state property. However, all these measures will have only a temporary effect and will not improve the economic situation in Russia, but will lead to its further deterioration.

In particular, the issue of money, which is at the level of 2 trillion rubles already in 2015, causes only an increase in inflation in the country. Since the beginning of this year, the overall growth in prices has made 12 %, which is a significant acceleration compared to the same period in 2014 (8.5 %) and 53 times greater than the rate of inflation in the EU. At this, for certain groups of goods inflation in Russia was even higher. Thus, the consumer price index for consumer goods market in annual terms has amounted to 16.4 %, while the food inflation — to 21 %.

In particular, the issue of money, which is at the level of 2 trillion rubles already in 2015, causes only an increase in inflation in the country. Since the beginning of this year, the overall growth in prices has made 12 %, which is a significant acceleration compared to the same period in 2014 (8.5 %) and 53 times greater than the rate of inflation in the EU. At this, for certain groups of goods inflation in Russia was even higher. Thus, the consumer price index for consumer goods market in annual terms has amounted to 16.4 %, while the food inflation — to 21 %.

In its turn, the tax increase will have extremely negative consequences for small and medium business in Russia, as well as for the country's oil and gas industry, which is already on the verge of profitability due to falling world prices for energy carriers. According to the statement of the Head of the OAO Rosneft I. Sechin, introduction of new taxes will inevitably lead to a halt of oil companies in the country, causing an acute shortage of petrol and other liquid fuels.

The problems of the Russian economy cannot be solved through domestic loans because most of people and enterprises physically have no extra money. Given this, the Russian government will be forced to resort to actual coercive measures to obtain such loans, including by blackmailing businesses under various pretexts. All in all, this way in 2016 they are going to receive 500 billion rubles. The above-said will slightly replenish the state budget of Russia, but will cause losses and the Russian business' backlash, and will lead to a rise in domestic debt to about 9 trillion rubles.

One can hardly expect real effect from the privatization of state property in the Russian Federation. On the one hand, privatization of economic assets contradicts Putin's policy, which is intended to increase state control over the economy, and on the other — Russia has completely lost its attractiveness to foreign investors through the West's political and economic sanctions.

Against this background, the real negative impact on the socio-economic situation in Russia will have further reducing of social spending and the government's actual refusal to support the economy. Firstly, this will lead to the next jump in the chain reaction — “reduction in domestic demand-reduction of production”, and secondly — it will finally deprive Russian businesses of state loans.

In general, the above-mentioned processes are returning Russia into the situation of the late 1980s-early 1990s, creating a real danger of a social explosion in the country and self-destruction of the Russian state as it happened with the former Soviet Union. At this, unlike the former Soviet Union, the collapse of Russia will be followed by a much harsher disasters including real possibility of a full-scale civil war in the Russian Federation. The ground for this has been created by V. Putin's regime through the deliberate formation of aggressive moods in the society of the country within the framework of building the so-called “Russian world”.

Does the leadership of the Russian Federation understand the inevitability of such a threat and its catastrophic consequences? Of course it does and makes all possible efforts (or it thinks it does) to protect exclusively its own interests. And the methods and ways of such actions fully correspond with those used by the former government of the USSR (in fact, by the Communist Party of the Soviet Union) on the eve of its collapse. Thus, the Russian oligarchic circles, and in fact — V. Putin's inner circle (according to some sources, first of all S. Chemezov, I. Sechin, A. Rotenberg, Yu. Kovalchuk, G. Timchenko, I. Shuvalov, A. Dvorkovich and others) are withdrawing capital from Russia in great mass both privately and under the guise of providing financial assistance to the partners of the Russian Federation, and through hidden (under the cover of authorized persons) purchasing of enterprises and real estates, investing financial assets into foreign companies' shares and government securities.

Does the leadership of the Russian Federation understand the inevitability of such a threat and its catastrophic consequences? Of course it does and makes all possible efforts (or it thinks it does) to protect exclusively its own interests. And the methods and ways of such actions fully correspond with those used by the former government of the USSR (in fact, by the Communist Party of the Soviet Union) on the eve of its collapse. Thus, the Russian oligarchic circles, and in fact — V. Putin's inner circle (according to some sources, first of all S. Chemezov, I. Sechin, A. Rotenberg, Yu. Kovalchuk, G. Timchenko, I. Shuvalov, A. Dvorkovich and others) are withdrawing capital from Russia in great mass both privately and under the guise of providing financial assistance to the partners of the Russian Federation, and through hidden (under the cover of authorized persons) purchasing of enterprises and real estates, investing financial assets into foreign companies' shares and government securities.

At the same time, V. Putin's regime will not give up its power just for a thank you, and will cling to it to the last. In this regard, in order to divert the Russian population's attention from socio-economic problems of the country, it will use all possible means and measures, including resumption of active hostilities against Ukraine, opening new fronts of Russia's armed confrontation (in particular with the countries of Central and Eastern Europe and the Baltic States), intervention in other conflicts and terrorist acts in the territory of the Russian Federation under the pretext of Islamists' attacks. All this will be forming Russia's image of a “besieged fortress” with “V. Putin as its one and only hope and support».