For Ukraine as an independent state, it is crucial to eliminate all the problems in the energy sector, which have been caused by inter-state relations with the Russian Federation. Because this issue is increasingly exacerbated the moment Russia tries to use energy factor as an instrument of pressure on Ukraine to return it into the sphere of its influence.

By the way, the current state of affairs in the Russian energy sector, on which Russia's economy depends directly, is far from ideal. And this directly affects the ability of Russia to achieve its foreign policy goals in relations with other countries, including Ukraine.

|

|

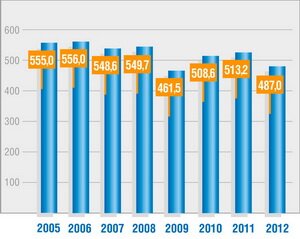

The volumes of gas production and export by “Gazprom” got reduced http://gazpromquestions.ru/ |

Work of the JSC "Gazprom", which plays a leading role in the implementation of Russian interests, now is accompanied by a number of problems caused by so-called "shale revolution" in global energy and infrastructure development and transportation of liquefied natural gas (LNG), that have fed the world, and, in particular, the European gas market and, consequently, have led to a sharp decline in demand for Russian gas and to fall of its price. For this reason, in 2012 the volumes of gas production and export by “Gazprom” got reduced, and by more than 10% decreased its incomes.

At the same time there has been a significant worsening of the problem with implementation of a number of energy projects that could thwart the plans of economic development of Russia and negatively affect its geopolitical ambitions. In particular, this concerns the prospects for output to full capacity of the new Russian pipeline "Northern Stream" (from Russia to Germany under the Baltic Sea), construction of which promised to strengthen Russia's positions at the European gas market and to reduce Russia’s dependence on Ukraine in gas transit, and thus to provide additional levers of influence over Kyiv.

|

| The gas pipeline "Northern Stream" http://ru.wikipedia.org/ |

Thus, today the gas pipeline "Northern Stream" is filled no more than 30-40%. After the leadership of the European Union refused to give into the disposal of "Gazprom" the European pipeline OPAL (capacity of 36 billion cubic meters per year), which connects the Russian point of the pipeline in Germany with German regions and Czech, and through it - with other segments of the European gas transmission system. European Commission justifies its position by a need to fulfill the Third EU Energy Package that does not involve one company monopolizing the functions of production, transportation and sale of gas. Automatically this causes losses and really makes uneconomical the use of the "Northern Stream" (actually blocking its functioning and development), but actually thwarts the mentioned above Russia’s intentions.

|

| The European pipeline OPAL http://novostienergetiki.ru/ |

Trying to fix this problem, the Russian side is trying to convince the EU leaders in it being necessary to withdraw the OPAL pipeline from under the EU Third Energy Package, which supposedly will answer European interests. In particular, this issue was raised at the highest levels by the RF President V. Putin at the Russia-EU Summit in Yekaterinburg in May this year. However, according to Western experts, the European Commission is unlikely to meet Russia’s demands, and break the EU’s own norms of Law.

|

| The main routes of Russian gas supplies to Europe http://aftershock.su/ |

Besides, the work of the pipeline "Northern Stream" is accompanied by an uncomfortable twist: at least two weeks every two or three months it is necessary to systematically stop it for technical prevention. The last such stop at the beginning of June this year, made Russia increase volumes of gas transit through Ukraine. The need of such prevention is caused by the low quality of the pipeline system, built rapidly (due to political decisions of the leadership, which sought to put pressure on Ukraine) and by its being placed underwater, which makes the pipeline’s work technically more difficult.

By the way, similar problems are typical of the currently functioning, also laid under the Black Sea, Russian-Turkish gas pipeline "Blue Stream" which has earned the fame of the most unprofitable "Gazprom"’s project.

The same fate will, probably, suffer another Russian gas pipeline project "Southern Stream", which is also laid to bypass Ukraine and also under the Black Sea. The Russian project will compete with a number of significant European projects in the so-called "Southern energy transport corridor", which provides construction of new routes of transportation of Caspian and Central Asian energy carriers to Europe, outside Russia.

|

| The project Nabucco-West http://bg-daily-news.eu/ |

The main of these projects is Nabucco-West (length of 1.3 thousand km). This is a shortened and cheaper version of the Nabucco transmission system, which provides routing of the pipeline from the Turkish-Bulgarian border through the territory of Bulgaria, Romania and Hungary to the Austrian city of Baumharden. It is supposed to supply with gas the countries that it crosses on its way, as well as the Balkan countries, Greece, Italy, Slovakia, Czech Republic, France, Germany and Ukraine via existing pipelines.

Today, in fact, have been completed the negotiations between the consortium Nabucco Gas Pipeline International GmbH and "Shah Deniz" (developer of a gas field with the same name in the Azerbaijani sector of the Caspian Sea) on the signing of the shareholders agreement, which is scheduled to be concluded in the nearest future.

Besides, are being considered several versions of routes for transportation of gas to Europe. In particular, a project of construction of the Trans-Adriatic gas pipeline from Turkey to Greece and Albania (at the bottom of the Adriatic Sea), and then - to European countries. At this, the key benefit of these projects, as compared with the Russian "South Stream", is that they are supported by the European Union, which aims to reduce its energy dependence on Russia.

In fact, self-defeating are also strategic plans of the Russian Federation to expand gas supply to China in order to diversify Russian gas export lines and thus to get more opportunities for pressure on the EU (threatening with reorientation the gas flows from West to East).

Despite the rising gas consumption, China today does not feel an urgent need for Russian gas. To this testify the perennial that actually have gone into the dead end, disputes between China and Russia over gas prices. However, against this background China is intensifying measures for implementation of more profitable for itself gas projects.

Thus, lately, Beijing has funded the construction of several parallel gas pipeline systems from countries of Central Asia - Turkmenistan, Uzbekistan and Kazakhstan. In future, another pipeline with China’s participation is going to be built from Turkmenistan to China, which will be exploiting the new powerful Halkynsh gas field.

China is also completing the construction of six terminals for liquefied natural gas, which, by their capacity exceed Russian gas pipeline project for supplying with gas the Chinese city of Xinjiang. Besides, in the PRC are under construction eight LNG receiving terminals. The introduction into service of all these terminals will enable China to get more gas than is offered by Russia under all its projects of gas exports to China (including "the Eastern gas pipeline" from one of the largest deposits in the RF-Chayandynskoye).

Chinese companies CNPC and Sinopec, as well as their foreign partners are taking action to develop China's shale gas, deposits of which, according to various estimates, are 50% higher than the capacity of similar deposits of the United States. This creates the potential for China’s becoming a world leader in gas production. China will surpass the United States that currently ranks first thanks to implementing large-scale shale gas projects on its territory.

In general, all these measures soon will allow China to withdraw from cooperation with Russia in the energy sector.

So, we can conclude that there is a strong tendency of Russia’s losing its positions at foreign gas markets. This undermines its economy, reducing the capacity of its impact on other countries. However, it also gives additional grounds to its partners in the energy sector, including Ukraine, to defend their interests before Moscow.

So, we can conclude that there is a strong tendency of Russia’s losing its positions at foreign gas markets. This undermines its economy, reducing the capacity of its impact on other countries. However, it also gives additional grounds to its partners in the energy sector, including Ukraine, to defend their interests before Moscow.

In particular, in the case of Ukraine, this may relate to the definition of the price of Russian gas and Russia’s attempts to have Ukraine involved in Moscow’s integration initiatives at the post-Soviet territories, especially in the Customs Union of Russia, Belarus and Kazakhstan.