Part 1

Before proceeding to the point, the author, guided by his personal experiences, points out that he is expressing his own opinion, because he knows how easy it is to assess someone else' actions, and how difficult it is to make right decisions.

In this article we shall deal only with the most dependent on the current aggressor — the Russian Federation — spheres of the Ukrainian energy sector.

The oil industry.

The biggest problem here is high dependence on oil from foreign plants (refineries), working fully or partially on Russian oil (Mozyr refinery in Belarus, Mazhekyay refinery in Lithuania, several refineries in Romania, the company Orlen in Poland, etc.).

Besides, a number of Ukrainian enterprises of the chemical industry (e.g. Kalush Scientific and Production Association Oriana in western Ukraine) are dependent on Russian exports of petrochemical raw materials, as a rule, by 100 %. These companies cannot be modernized and, accordingly, the quality of their production (due to the mismatch of the quality of raw materials) will not improve.

The high-quality products of the petrochemical industry, as a rule, are imported by Ukraine. Although producing such products would not be a great problem.

Objective data:

|

|

Schematic map of major oil and gas deposits in Ukraine http://www.photoukraine.com/ |

At the moment Ukraine produces just over 2 million tons of oil (in 2013 it produced 2.4 million tons). Another 1 million or so tons is imported from Russia. About 9 million tons of oil products are consumed.

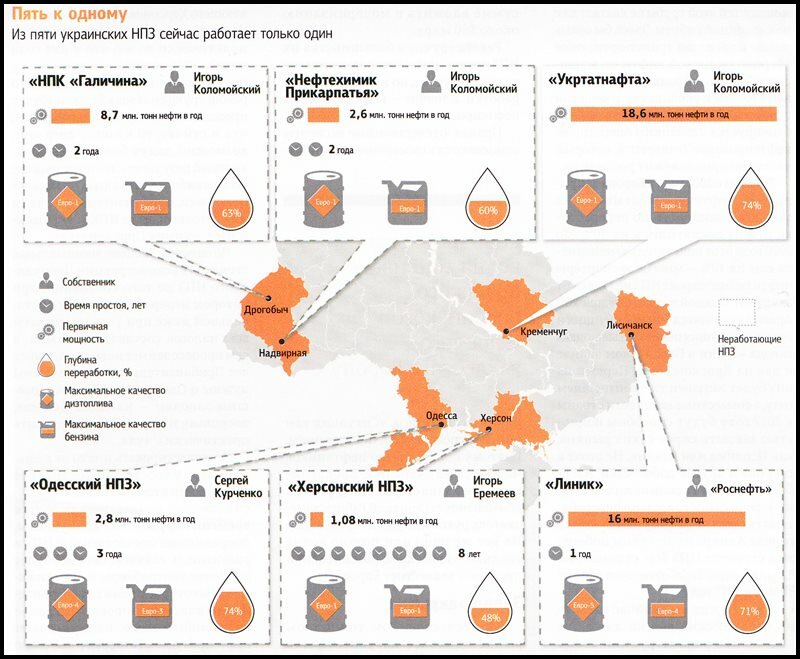

The country has 6 refineries with lagging technology of oil refining. Years ago (in Soviet times), they could process more than 51 million tons of oil (usually produced in Russia) and produce oil of the Euro2 and Euro3 quality (good at the time). Since then, little has changed — the quality of Ukrainian oil products has remained at the same level. However, some of the current owners of refineries claim that they have modernized their businesses and are producing better products. But I am sure this is not true. Most likely, the notorious Ukrainian corruption was involved.

|

|

Refineries in Ukraine – capacities, system operation, the owners (2013) http://zet.in.ua/ |

Last year, Ukrainian refineries produced a little less than 2 million tons of low-quality oil products. Another about 0.5 million tons were produced by Shebelynka State Gas Processing Plant (GPP). Total: less than 2.5 million tons of oil products out of more than 9 million tons available at our market

That is, the difference (as a rule, high-quality) was obtained from refineries of Belarus, Lithuania, the Russian Federation, Romania, Poland, which are supplied, as a rule, with Russian oil. These refineries had been built during the life of the socialist camp. They also used to produce products of Euro 2 and Euro 3 quality. Now they are modernized.

Low-quality petroleum products still have a demand in Ukraine because of the existing equipment of the Soviet (or post-Soviet) make, being used in rural areas. However, whether we like it or not, this machinery will have gone into oblivion already by the end of this decade.

And at the same time there will rise in its full length the question of supplying the Ukrainian market with high quality oil products. Will the current (technologically lagging behind) Ukrainian refineries meet the demand?

There are three possible ways of solving this problem:

- Transition to a 100% import of the needed petroleum products. It would result in the actual elimination of the Ukrainian oil refining industry, due to which fact would suffer, as they say, the human factor (industrial school, jobs, etc.) and this is not logical from the point of view of national security.

- Modernization of existing Ukrainian refineries. (To do this, we would need the same amount of funds as for the construction of new refineries. Moreover, the process of allocating funds for modernization is fraught with tensions between the owners of refineries and the state).

- Construction of a new modern petrochemical complex capable of producing high-quality liquid petroleum products and advanced materials for the chemical industry.

Promising is creation (construction) in Ukraine of a modern petrochemical complex (it produces a much wider range of products than a refinery) with the help of loans. Such a complex is possible under these conditions:

- Availability of raw material — oil.

- Availability of technical and human resources.

- Availability of markets for manufactured products (oil products and raw materials for the petrochemical industry).

Conditions of creation (construction) modern petrochemical complex in Ukraine

In Ukraine, there is no first condition (oil being in limited quantities). But we have the other two conditions, which the majority of our current potential partners do not have (we have opportunities and markets). Russia as a partner, of course, is not considered.

To solve the above-mentioned and other issues of national security, it makes sense to build in Western Ukraine a petrochemical complex for processing 8-10 million tons of high quality oil per year with the participation of three parties:

- Ukraine;

- A country having oil;

- A country open to liquid markets (the most appropriate — a member of the EU).

Most optimal would be processing 8–10 million tons of oil per year.

Even during the third president of Ukraine such a project was worked successfully on. Now it makes sense to implement it, because there is no other option to ensure real independence of Ukraine.

Commercial and political benefits for supporters of the project:

- Ukraine, in general copes with the problem of supplying the domestic market with oil products and raw materials for the chemical industry. At this, partial import is not excluded and, therefore, a competition among transparent importers will remain. Also, this will not create an additional stress for honest importers. The issue of using (planned) the «Odessa-Brody» oil pipeline will also be solved. The producer will receive free access to competitive markets of petroleum products, in particular to the EU markets, first of all thanks to lower costs due to lower wages. Relatively easily will be solved the problem of employment of skilled workers at Western Ukraine's refineries.

- The country-owner of oil will implement its strategic interest in liquid markets (EU): it will be selling petroleum products, not crude oil.

- A third country (the most appropriate — a member of the EU) will be the guarantor of the Complex' functioning by European transparent rules and, if necessary, will balance the marketing of products. In particular, it will increase its influence on the competitive markets (EU markets). And the fact that the products manufactured in Ukraine will have all chances to be competitive, is mainly due to the fact that our workforce for a long time will be paid less than, for example, in the EU.

Gas industry.

|

|

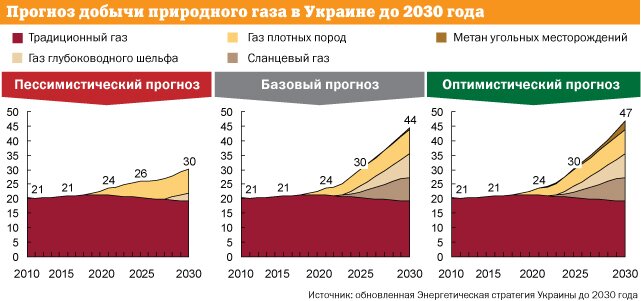

Forecast of natural gas production in Ukraine until 2030 http://ekonomika.eizvestia.com/ |

Objective data:

Ukraine (with the Crimea) consumes 50 to 52 billion cubic meters of natural gas a year. In the Crimea, gas is produced and consumed in about equal amounts — about 2 billion cubic meters.

The structure of consumption during a year is as follows: 16–17 billion cubic meters «to the stove burner» (directly to the population), more than 0.5 to 1.0 billion cubic meters are consumed by the budget sector, 7 to 9 billion cubic meters — by municipal economy, about 23–25 billion cubic meters — by industry (in particular, chemistry and metallurgy, the majority of products of which are exported to the world markets). These volumes for the economy also include 4–6 billion cubic meters of process gas securing transits.

We produce (taking into account the Crimea) 20–21 billion cubic meters. We import 28–30 billion cubic meters of gas.

Structure of natural gas consumption in Ukraine

It is technically possible to import gas by reverse pattern: more than 5 billion cubic meters through Poland and Hungary, and through Slovakia — up to 10 billion cubic meters (due to the already made relatively small investments) — the so-called newly discovered «small reverse». So far has not been involved the so-called «large reverse» — up to 30 billion cubic meters of gas through Slovakia (also with a relatively small investments to create 300 — 400 meters of a bypass pipeline on the territory of Slovakia, which is usually done in 2–3 weeks and is not seriously discussed) and the same 5 billion cubic meters through Poland and Hungary.

All this information was received from experts of Czechoslovakia (Slovakia), the USSR (Ukraine), Poland and Hungary, who used to be involved in designing the GTS. Then it was confirmed on site in Ukraine, Slovakia, Poland and Hungary.

As you can see, Ukraine until recently (until imports from Russia stopped), had been providing itself (population and industry) with natural gas of domestic production by about 40%. About 60% of gas had been imported. Until 2012, all imports of gas, according to the old Soviet tradition, had been from the Russian Federation. Since 2012 — the gas, apart from Russia's Gazprom, has been imported by the German company RWE imports through Poland, Hungary and more recently — through Slovakia. As it turned out, the German RWE, to some extent is also dependent on Russia. But a good news is that in 2015, thanks to the initiative of Naftogaz of Ukraine, gas will be imported by other Western firms too.

Thus, Gazprom used to supply 26 — 30 billion cubic meters of gas. And RWE — 1–2 billion. Such a structure of importing gas cannot guarantee our national security.

The annual consumption of natural gas

For comparison: Poland, nearly equal to Ukraine in area and population, consumes over 14–16 billion cubic meters of gas. While we — more than 50! Despite the fact that Poland's GDP is three times bigger than ours! This proves once again that our main reserve in the gas industry is reduction in gas consumption.

On the other hand, gas imports from Russia can be completely replaced by imports from other European countries, provided, in particular, that the supply scheme will be replaced by the reverse one. This is technically absolutely possible. And recently it was shown to the world by introducing the so-called «small» reverse through Slovakia of up to 10 billion cubic meters of gas per year. Now we need to decide on a large reverse — a large amount of gas (more than 28 billion cubic meters) from the eligible for us European markets. And the question of Gazprom's reserving of transit capacities, contrary to European legislation, cannot be a serious obstacle. As well as minor engineering work. They both need negotiations and political support. We are supported by Brussels and almost the entire democratic world. But negotiations should have started as early as March of this year... Now, at the end of August it is too late to worry about the upcoming heating season! The world practice knows no precedent when 1.5–2 months before the beginning of the heating season, someone started and successfully completed negotiations with potential gas suppliers and even contracted it (even during the war, going on here, and not from potential suppliers). Such negotiations need at least several months, and a serious political support. Such negotiations and signing of contracts must be completed by mid-October (when ends the period of pumping gas into UGS). The most suitable for us may be a Norwegian company Stattoil, competing with the supplier-leader in the European markets — Russian Gazprom. It is also advisable to negotiate with other companies, in particular, those which have just appeared at the market.

I hope that such negotiations were held by representatives of Ukraine in such high secrecy that even the author of these lines, like most ordinary citizens of Ukraine, had no idea about them. As to the recent trip of gas delegations to the aggressor in Moscow – it was just a diversion, a distraction! But to be fair, it should be noted that in the years to come, there will be other heating seasons, in particular, the 2015/16 season. As well as the summer... And it is unlikely that the relevance of gas imports will be completely removed from the agenda. After all, during the coming 8–10 years, we are doomed to import gas. But not from the aggressor!

In a word, it is never too late to look for European suppliers, to negotiate with them, to contract gas. In the future, the sooner we do it, the better. Right now at Western markets, not more than 3 billion cubic meters of gas are available without additional effort. While today we need about 30.

In a word, it is never too late to look for European suppliers, to negotiate with them, to contract gas. In the future, the sooner we do it, the better. Right now at Western markets, not more than 3 billion cubic meters of gas are available without additional effort. While today we need about 30.

So, in the presence of resource (gas) at European markets (for us the most appropriate is the hub Baumgarten in Austria) Ukraine could completely give up Russian gas imports already in 2014, refocusing on western suppliers.

Of course, now such gas (through reverse, from European markets), would be more expensive by 100 — 120 US dollars (this includes transportation costs and the provider's profit), as compared with the gas received from Russia at a fair market price. Yet it is cheaper than the current «political» Russian price for Ukraine of 485 US dollars per 1 thousand cubic meters. However, in the situation of Russian aggression, the price of the imported gas should not be a priority for us, as no one ever cooperates with the aggressor.

Of course, simultaneously with the establishment of «reverse». we should actively and efficiently perform the main strategic task: to reduce gas consumption, and in the future — to completely give up its imports.